ALL >> General >> View Article

Closed-loop Mobile Payments: All You Need To Know!

Executing payments via digital wallets/ Mobile payments solutions have become the order of the day owing to the emerging digital technologies and an increasing dependency on smartphones.

According to a research report published by the online portal, Mordor Intelligence, “The market value of mobile payment systems was 1449.56 Billion USD in the year 2020. The mobile wallet market is expected to grow at a CAGR of 24.5% during the next few years and the market value is predicted to reach 5399.6 Billion USD by the year 2026”.

Digital wallets have transformed the manner of making payments altogether. The two major categories under this type of payment methodology are open loop and closed loop mobile payments. The open-loop payment system involves using a single digital wallet via smartphones for making payments at several locations. Closed-loop mobile payments, on the other hand, requires prepaying a certain amount of money to one specific merchant or business brand just like using loyalty/gift cards at ...

... an apparel store or an eatery.

Out of these two mobile payment categories, the closed-loop approach is more preferable by merchants as well as consumers. In fact, the closed-loop payment model has revolutionized mobile payment one step further and elevated it to the next level! Let’s gather some quick insights on closed-loop mobile payments and the business benefits of adopting this approach.

What is Closed-Loop Mobile Payment?

A closed-loop payment refers to the payment transaction wherein a customer uploads money into a spending account linked to a payment device, just like the functioning of a gift card. This kind of payment happens between a spending account and a particular business brand. The mobile equivalent of this payment system is termed closed loop mobile payment. A closed-loop payment system uses mobile apps for managing gift cards and accounts via smartphone devices. Closed-loop mobile payment solutions allow users to check their balance within the system, make purchases using a mobile app instead of a physical card, and top up their account balance effortlessly. Customers can make payments using mobile devices/tablets to a specific retailer against an established account balance. Some of these solutions even provide the option of automatic balance top-up.

Any branded mobile payment or loyalty solution falls under this category. The TimmyMe app by Tim Hortons and the Starbucks smartphone app are popular examples of the closed-loop mobile payment model.

What is meant by a Closed-Loop Card?

A closed-loop card, also known as a single-purpose card, is an electronic payment card which the cardholder can use for executing purchases from a specific brand. Such cards usually bear the logo of the company where it can be used instead of bearing the logo of a primary payment processor such as American Express, MasterCard, Visa, etc.

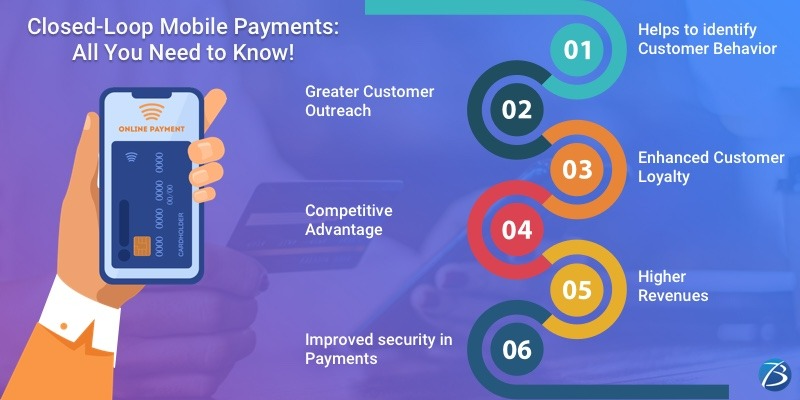

Benefits of Closed-Loop Mobile Payments

Identifying Customer Behavior for Creating Effective Marketing Campaigns

This mobile payment processing model helps entrepreneurs to capture big data based on millions of customer transactions and then, analyze this data for gaining deeper insights into the buying habits of consumers. Once, the businesses get a thorough understanding of their target market and identify the purchasing habits of their customers, they can create customized promotions/offers and deliver the same to customers’ mobile devices.

Greater Customer Outreach

Mobile technology simplifies sending out purchase reminders to customers via notifications. Moreover, businesses can even set up geo-targeted notifications which get triggered whenever potential consumers are close to their store.

Enhanced Customer Loyalty

The ability to send customized promotional offers and loyalty incentives to customers via smartphone devices not only helps in retaining consumers but also enhances their loyalty quotient.

Competitive Advantage

Using the closed-loop mobile payment model, customers enjoy several benefits like smartphone friendliness, automatic balance top-up, the option of pre-ordering for avoiding line-ups, being able to consolidate several gift cards, and many more. This makes your brand the obvious choice for customers.

The exclusive nature of a closed-loop mobile payment system enables business brands to monopolize customers’ smartphone devices concerning services and products within their niche.

The aforementioned advantages help businesses gain a competitive edge over peers.

Higher Profits

When users add money to fund their mobile wallet apps or e-gift cards, it implies that they have technically spent money within your store. Furthermore, if customers fail to use up their remaining balance, you gain extra profit.

Why should Business Brands Adopt the Closed-Loop Mobile Payment Approach?

It’s high time businesses should adopt the closed-loop mobile payment strategy. Take a look at the reasons!

• Billions of individuals across the globe own smartphones. As such, your targeted audience is more likely to possess a smartphone device than your firm’s gift/loyalty card. Besides, modern tech-savvy consumers are on the lookout for ways and means that will allow them to link their payment wallets with mobile devices. And, the closed-loop approach perfectly befits this requirement.

• Consumers express interest in this system due to the bar code scanning abilities of modern mobile devices.

• Such systems promise improved security. This is because they are not tied into carrier networks, users’ credit cards, or bank accounts, thereby adding an extra security layer between the merchant and the bank account.

• Closed-loop mobile payments are less complicated and easy to execute.

• This approach proves profitable for vendors as it involves lower purchase fees in comparison to direct credit card transactions.

Concluding Thoughts:

A closed-loop mobile payment system proves profitable for the merchant as well as their consumers. Therefore, if you possess the necessary resources, commence the mobile app development process by partnering with reliable developers and a merchant service provider for architecting an impeccable closed-loop payment system.

Are you on the lookout for a dependable software firm for building a closed-loop mobile payment system for your business? Contact Biz4Solutions, a renowned Offshore Software Development Company in India, with 10+ years of experience in serving global clientele!

To know more about our core technologies, refer to links below:

Add Comment

General Articles

1. Glass Ionomer Cement Fillings And Treatment ProcedureAuthor: Patrica Crewe

2. How Is Smelting Different Than Melting?

Author: David

3. Transforming Healthcare Revenue With Intelligent Ai Medical Coding Automation Solutions

Author: Allzone

4. Flirty Pick-up Lines Kya Hote Hain? – Complete Beginner Guide (2026)

Author: Banjit Das

5. Top 10 Altcoins To Invest In 2026:

Author: elina

6. Dog Photography Guide: Perfect Dog Images Kaise Click Kare (beginner Se Pro Tips)

Author: BANJIT DAS

7. On-demand Beauty Service App Development: Business Model & Revenue Strategy

Author: Rohit Kumawat

8. Industrial Fasteners: Types, Materials & Key Applications Guide

Author: caliber enterprises

9. How To Find High-quality Cat Images Online – Complete Guide

Author: BANJIT DAS

10. Animal Jokes Meaning – क्या होते हैं एनिमल जोक्स

Author: BANJIT DAS

11. Remove Negativity With Maha Mrityunjaya Jaap And Navgrah Shanti Puja

Author: Pandit Shiv Narayan Guruji

12. نبذة عن الجامعة الامريكية في راس الخيمة وكلياتها وتخصصاتها

Author: AURAK

13. Y1 Game: The Rising Trend Of Digital Play And Real Rewards

Author: reddy book

14. History Of Doctor Jokes – कैसे शुरू हुए मजेदार मेडिकल जोक्स

Author: BANJIT DAS

15. Why Is Reeth U Sarvvah Known As India’s Best Astrologer And Numerologist?

Author: Reeth U Sarvvah